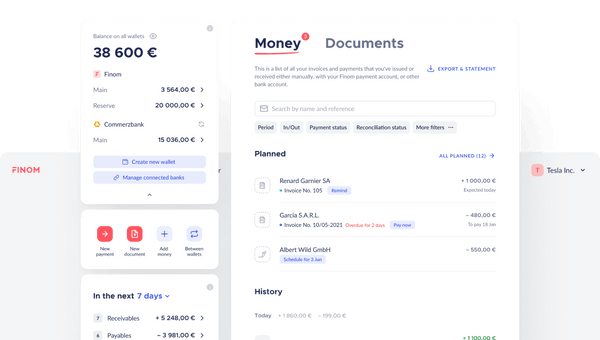

With a FINOM business account, you have access to the same important services that a traditional bank account provides, such as the ability to withdraw and deposit your money from the account.

To make a deposit to your account, you can make a SEPA transfer from your current bank account. To make a withdrawal, you can use your physical FINOM card at all European ATMs. This allows you to withdraw up to € 10,000 per month free of charge.

To make a withdrawal, you can use your physical FINOM card at all European ATMs. Up to € 10,000 per month can be withdrawn free of charge in Germany and Italy and up to € 2,000 per month (depending on your plan) in France.