Free physical & virtual cards

Issue multiple free VISA debit cards for you and your team, 0% commission

- ATM withdrawal limit up to € 5 000 per card

- Issue, limit, top up or block in a single click

- Pay on the go with Apple Pay & Google Pay

Your GmbH account in 24 hours – with a German IBAN and a free trial

Opened fully online. No hidden commisions. Up to € 3% cashback.

Issue multiple free VISA debit cards for you and your team, 0% commission

Each wallet for the specific expense item. No more accidental spending of money you set aside

Yes, when opening a business account online with Finom, you immediately receive a German IBAN. Finom offers entrepreneurs and self-employed professionals a fast and simple way to open a business account in less than 24 hours and start business operations right away. The issued German IBAN is fully functional and supports SEPA transfers, among other features.

Open accountTo open a business account for a GmbH online with Finom, the following documents are required:

Yes, a GmbH in formation (GmbH i.G.) can open a business account with Finom. Finom also offers a fast and uncomplicated online account opening process for companies in the formation phase, tailored specifically to their needs.

What requirements must be met?

To open a business account for a GmbH i.G. with Finom, the following conditions must be met:

To open a business account online for a GmbH i.G. (in formation) with Finom, the following documents are required:

Yes, Finom offers comprehensive support for setting up a GmbH and allows for the simultaneous opening of a business account. In cooperation with specialized partners such as firma.de, founders can manage the entire formation process efficiently and easily.

Services at a glance:

Thanks to these integrated services, founders can go through the company formation process and account setup efficiently and without delays. Finom ensures that all required steps are professionally coordinated to guarantee a smooth company formation.

Opening a business account with Finom is free of charge. The ongoing costs depend on the selected plan and the specific needs of the GmbH. Finom offers various account models with different features and pricing. Possible costs include monthly base fees, transaction fees for transfers or card payments, and charges for additional services like international payments or currency conversions.

The entry-level package starts at €9 per month (with annual payment) and includes account management, debit cards, invoicing services, multibanking, and expense management. The first month is free for testing.

Yes, opening and using a business account for a GmbH with Finom is secure. Finom adheres to the highest security standards and uses cutting-edge technologies to protect customer data and funds.

The account opening is free. Finom offers various business account plans for GmbHs depending on the required features and company size. The Basic plan, recommended by Finom, costs €9 per month (plus VAT) with annual billing and includes account management, debit card issuance, invoicing, multibanking, and expense management.

For companies with greater needs, higher-tier plans like Smart and Pro are available, offering additional features. Every plan can be tested free for 30 days, allowing businesses to find the right fit. Annual payment comes with a discount.

A business account with a German IBAN for your GmbH.

Connect all your other online banking accounts to Finom. Access all your wallets, transactions, account statements, and tax assessments across several banks on a single platform. You can even delete those bank apps altogether

Use your business account to manage team expenses and enhance your financial planning

Subscription plans at a fair cost tailored to fit your business.

For freelancers who need simple, essential features

For individual entrepreneurs or small teams taking their first steps. Simple, essential tools to start and stay in control

For small to medium-sized businesses with straightforward needs. Flexible tools and higher limits for daily operations

Business account

Business account

Business account

Users included

1

Users included

2

Users included

Cashback

0%

Cashback

1%

Cashback

3%

AI Assistant

AI Assistant

AI Assistant

Chat support

Up to 1 business day

Chat support

Up to 3 hours

Chat support

Up to 3 minutes

Account Manager

Account Manager

Account Manager

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Monthly interest rate

1% - 1,9%

Monthly interest rate

1% - 1,9%

Monthly interest rate

1% - 1,9%

Credit line maintenance per day

€1

Credit line maintenance per day

€1

Credit line maintenance per day

€0,5

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€2 500

Free outgoing SEPA transfers

€25 000

Free outgoing SEPA transfers

€50 000

Free VISA physical cards per user

0

Free VISA physical cards per user

1

Free VISA physical cards per user

3

Free VISA virtual cards per user

1

Free VISA virtual cards per user

3

Free VISA virtual cards per user

10

Outgoing international payments

1%

Outgoing international payments

0.50%

Outgoing international payments

0.40%

Role and user management

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Bulk payments

For individual entrepreneurs or small teams taking their first steps. Simple, essential tools to start and stay in control

For small to medium-sized businesses with straightforward needs. Flexible tools and higher limits for daily operations

For small to medium-sized businesses ready to scale. The flexibility to grow with advanced features and higher limits

Business account

Business account

Business account

Users included

2

Users included

Users included

Cashback

1%

Cashback

3%

Cashback

unlimited cashback up to 0,5%

AI Assistant

AI Assistant

AI Assistant

Chat support

Up to 3 hours

Chat support

Up to 3 minutes

Chat support

Up to 3 minutes

Account Manager

Account Manager

Account Manager

Account Management team

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Monthly interest rate

1% - 1,9%

Monthly interest rate

1% - 1,9%

Monthly interest rate

1% - 1,9%

Credit line maintenance per day

€1

Credit line maintenance per day

€0,5

Credit line maintenance per day

€0,5

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€25 000

Free outgoing SEPA transfers

€50 000

Free outgoing SEPA transfers

€100 000

Free VISA physical cards per user

1

Free VISA physical cards per user

3

Free VISA physical cards per user

3

Free VISA virtual cards per user

3

Free VISA virtual cards per user

10

Free VISA virtual cards per user

Outgoing international payments

0.50%

Outgoing international payments

0.40%

Outgoing international payments

0.20%

Role and user management

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Bulk payments

For small to medium-sized businesses ready to scale. The flexibility to grow with advanced features and higher limits

For small to medium-sized businesses scaling at speed. Our most comprehensive package with concierge-level support and full customization

Business account

Business account

Users included

Users included

Cashback

unlimited cashback up to 0,5%

Cashback

unlimited cashback up to 1%

AI Assistant

AI Assistant

Chat support

Up to 3 minutes

Chat support

Up to 3 minutes

Account Manager

Account Management team

Account Manager

Dedicated Account Manager

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Monthly interest rate

1% - 1,9%

Monthly interest rate

1% - 1,9%

Credit line maintenance per day

€0,5

Credit line maintenance per day

€0,5

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€100 000

Free outgoing SEPA transfers

Free VISA physical cards per user

3

Free VISA physical cards per user

3

Free VISA virtual cards per user

Free VISA virtual cards per user

Outgoing international payments

0.20%

Outgoing international payments

0.10%

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Our servers are protected and hosted in the European Union

To minimize risks, we’ve partnered with one of the largest multinational banks, BNP Paribas, to hold your funds

We have a separate Safeguarding Foundation supervised by the DNB to manage your money

Your money is protected with secure passwordless authentication and single-use passwords

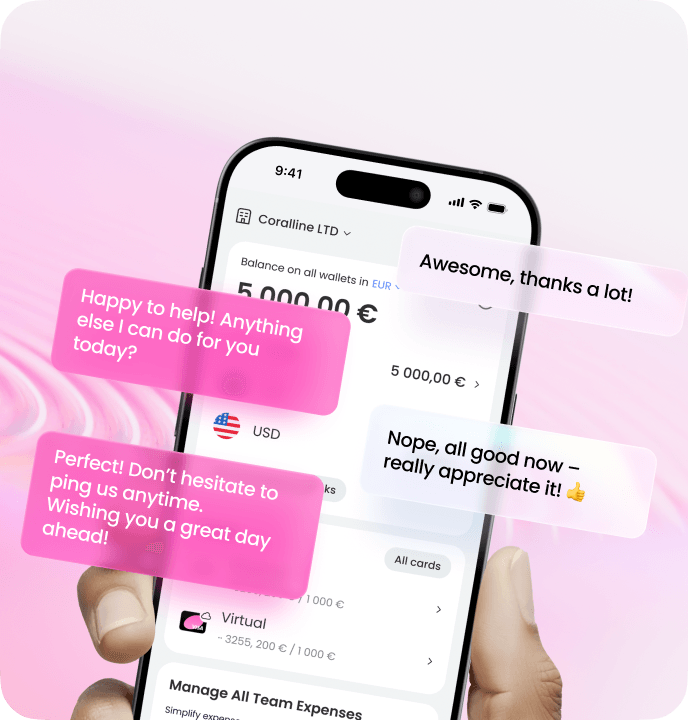

Help is just a click away

Interactive Help Center available 24 hours

24/7

Fast response time

Contact us on e-mail: hello@finom.co

Yes, a GmbH generally requires its own business account. This is essential for separating company transactions from your personal finances.

A separate account simplifies bookkeeping and tax reporting. Moreover, it is a prerequisite for company formation to ensure clear and transparent financial management.

With Finom, you can quickly and easily open a business account for various legal forms such as GmbH, UG, GbR, AG, as well as for freelancers and self-employed individuals. Trust Finom – open your business account online and receive your IBAN instantly

.A business account for a GmbH (limited liability company) can only be opened by authorized individuals. The following applies:

Managing Director as primary authorized person

Only the managing director can open the account, as they represent the company externally in accordance with § 35 GmbHG. If the GmbH has multiple managing directors, authorization depends on the commercial register:

Authorized signatories and representatives

If the managing director cannot or does not want to open the account personally, another individual can be authorized:

Yes, a GmbH must have a separate business account. Although there is no direct legal requirement, the payment of the share capital requires an account in the name of the GmbH i.G. in accordance with §7 Para. 2 GmbHG.

In addition, a clear separation between business and private assets is necessary in order to comply with tax regulations and to ensure proper accounting in accordance with the GoBD. Without a separate account, the tax office and auditors would not be able to recognize operating expenses, and in the event of insolvency, limited liability would be jeopardized.

A business account is also indispensable for practical reasons: it facilitates payment transactions, bookkeeping and the connection to tax and financial systems.

Plan configurator

1 / 4