Business accounts that help you manage e-commerce transactions

See how our tools simplify and optimize your operations

Expense management

Customize individual spending limits and set spending policies

Scheduled transfers

Set up recurring payments to suppliers and automate vendor payments

Seamless integrations

Connect your store to top business and accounting tools

Cashback

Get up to 3% cashback in real money

Easy accounting for expanding operations

- Integrations with top accounting tools like DATEV, sevdesk, and Lexoffice

- Auto-reconciliation and transaction matching

- Automated reconciliation

- 50+ tools for business

- Secure accountant access

Expert e-invoicing that gets you paid faster

Generate compliant e-invoices in seconds

Multiple languages and currencies

Automated VAT calculations

Customizable templates

Automated payment reminders for your clients

Optimized financial management for e-commerce

Automate and streamline your accounting and financial operations

Detailed insights

Know how much you’ll have in 7, 14, 30 or 90 days based on regular transactions

Automated and bulk payments

Schedule your regular payments for months in advance and process them all at once

Multibanking

Connect all your business accounts to Finom and control your cash flow

Fraud protection

Advanced security features protect your transactions and business

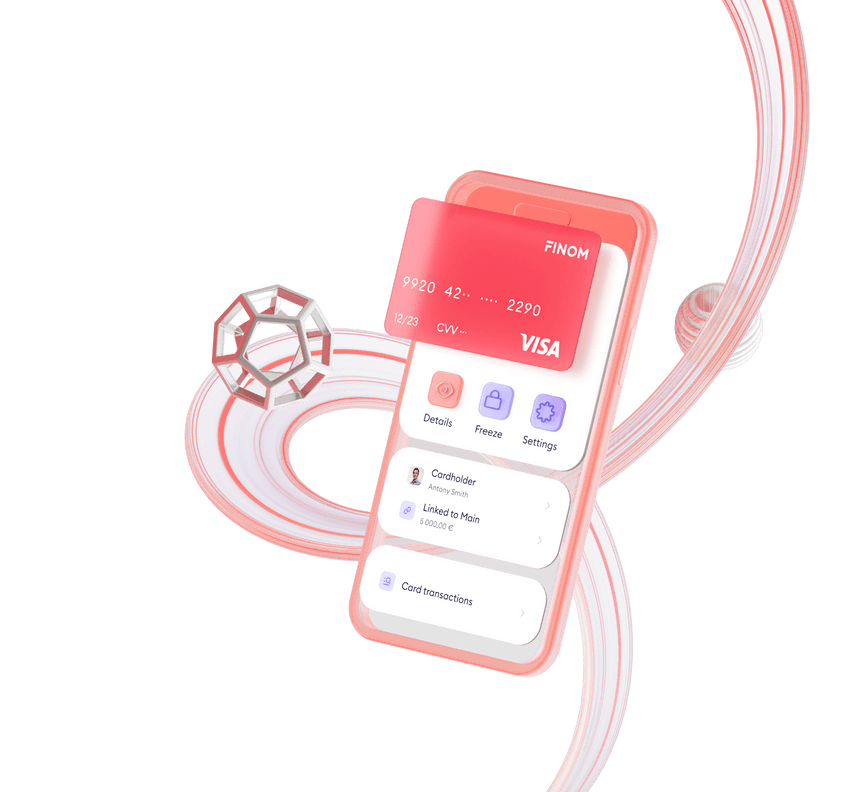

Business debit cards for online stores

- Earn up to 3% cashback and save money on all business purchases

- Issue physical and unlimited virtual cards

- Set controls for your team and track transactions in real-time

- Pay effortlessly with Apple Pay & Google Pay

Get started in a few minutes

Open a business account online with no paperwork

- Sign up online from your phone or desktop

- Let us verify your data

- Get your account ready to use

FAQ

What is a business account and why do I need it?

A business account is a financial account for managing company transactions and expenses. It helps you separate personal and business finances, simplify accounting, and access financial tools designed to support business growth – and it is often required legally.Who can open a business account?

Our business account will work for online stores of all sizes. Whether you're a startup, a growing e-store, or an established marketplace, you can open an account and save time and money with our tools.Is Finom suited for e-commerce only?

While our platform is tailored for e-commerce businesses, any company that handles frequent transactions, vendor payments, or global sales can benefit from our tools.What payment methods are supported?

Finom supports several payment methods, including SEPA transfers, card payments, and more.Can I manage multiple e-commerce stores with one Finom account?

Yes! We support multibanking, which allows you to connect and manage all your business accounts in one place, simplifying cash flow management across multiple stores.How long does it take to open an account?

Signing up is quick and paperless. Simply apply online from your phone or desktop, verify your data, and your IBAN will be ready in 24 hours.Is my customers’ payment information safe with Finom?

Absolutely. We maintain the highest data security standards to protect your customers’ payment information.How safe is my money with Finom?

Your money is in safe hands because we provide a high level of security to protect it: - With cutting-edge measures such as Passkeys and the added shield of 3D Secure, confidence accompanies every transaction. - Your account is exclusively linked to your smartphone, providing an additional layer of protection, while real-time push notifications keep you informed of all account activity. - Harnessing the power of artificial intelligence and machine learning, our platform is fortified to safeguard your account against financial crime and card fraud. - The app allows you to customize security to your preferences: you can instantly block or freeze your cards, modify your PIN, and set up spending limits and access controls. For accounts operating under Finom’s own licence, there are also legal regulatory measures of the institution providing your business account in addition to the security measures on the Finom platform and applications provided by PNL Fintech B.V., i.e. Safeguarding your account via Finom Payments B.V.: - When you add money to your Finom account or receive payments, we ensure that the equivalent value of electronic money is placed in your account. - It’s important to note that your Finom payment account isn’t a deposit account, which means we can’t pay you interest due to legal restrictions. But rest assured, we keep your money safe and never lend it to anyone else. - We’ve established a separate Safeguarding Foundation, supervised by the DNB, to manage your money as safeguarded customer funds. - We’ve partnered with reliable European banks like BNP Paribas to hold your funds. BNP Paribas is one of the largest banking groups in Europe, minimizing any risk. - Even in unlikely scenarios, such as Finom or BNP Paribas facing bankruptcy, your safeguarded customer funds remain protected. They are not accessible to Finom’s creditors and would be returned to you under the supervision of the DNB. For more information, please refer to the Terms of Finom Payments. For accounts operating under Solaris licence, there are also legal regulatory measures of the institution providing your business account in addition to the security measures on the Finom platform and applications, i.e. German Deposit Guarantee Scheme (DGS), where your money may be protected for up to €100,000 via Solaris SE and not PNL Fintech B.V. For more information, please refer to the Terms of Solaris SE.Under which license does Finom operate?

PNL Fintech B.V. (Finom) is a cooperating partner of a tech company with a full German banking license Solaris SE (Germany) and an agent of a licensed electronic money institution Finom Payments B.V. (the Netherlands, Belgium, Spain, France, Italy, and other EEA countries). Finom Payments BV (Finom) is a licensed electronic money institution authorized by the Dutch Central Bank, De Nederlandsche Bank (DNB), to operate in the European Union (EU) and the European Economic Area (EEA).Is my data safe with Finom?

Finom protects your data and guarantees the highest level of security: Finom has no access to your online banking credentials, and they are double-encrypted (for additional protection) using passkeys or a one-time password that must be entered each time you try to log in). All data transfers are transmitted over TLS-encrypted channels and are thereby protected via end-to-end encryption. We do not store your personal data against your will or without your explicit consent; Finom is GDPR (DSGVO for Germany and RGPD for France) compliant, which means that you can revoke your consent to the processing of your personal data at any time. Finom Privacy Policy regulates the processing of your personal data.