Free physical & virtual cards

Issue multiple free VISA debit cards for you and your team, 0% commission

- ATM withdrawal limit up to € 5 000 per card

- Issue, limit, top up or block in a single click

- Pay on the go with Apple Pay & Google Pay

Your free business account in just 15 minutes – 100% digital and mobile

Opened fully online. No hidden commisions. Up to € 3% cashback.

Issue multiple free VISA debit cards for you and your team, 0% commission

Each wallet for the specific expense item. No more accidental spending of money you set aside

No, sole traders in Germany are not legally obliged to open a business account. There is no legal requirement that prescribes a mandatory separation of private and business finances.

However, the use of a business account is strongly recommended for practical reasons:

A business account is therefore not a legal requirement, but a clear advantage for professional day-to-day business.

Open accountOpening a business account for sole proprietorships with Finom usually only takes 15 minutes. The entire process is completely digital and requires neither paper documents nor a visit to the bank.

After online registration and successful video identification, the account is set up immediately. In most cases, the German IBAN is available immediately afterwards so that the account can be used straight away.

The following documents are required to open a Finom business account for sole traders:

The account can therefore also be opened without a trade license, provided that the required documents are submitted within the deadlines.

A business account with Finom offers sole traders a wide range of practical benefits and is specially tailored to the requirements of self-employed and freelancers:

Finom thus enables sole traders to get started with banking quickly, efficiently and professionally – with functions that are specially tailored to everyday business life.

Yes, at Finom sole traders can open their business account completely online – fast, paperless and without visiting a branch. It usually only takes 15 minutes to open an account.

The process includes:

The account is ready for use immediately afterwards.

Yes, with the “Solo” tariff, Finom offers a permanently free business account specifically for sole traders, freelancers and the self-employed.

There are also fee-based tariffs with extended functions available for growing requirements – all start with a 30-day free trial period.

Finom attaches great importance to security and uses state-of-the-art technologies such as Passkeys and 3D-Secure to secure every transaction. Linking the account to your smartphone and real-time push notifications provide additional protection against unauthorized activity.

The platform uses artificial intelligence and machine learning to protect your account from financial crime and credit card fraud. You have the option to customize security settings, including card blocks, your PIN, spending limits and access controls.

In addition to these technical security measures, Finom also implements legal regulatory measures. Finom Payments B.V. ensures that your money is kept safe. Although it is not a deposit account and no interest is paid, your money is protected by a security foundation supervised by DNB. This foundation manages customer funds securely and separately from Finom’s operational funds

In addition to the business account, Finom offers other financial products and services for sole traders:

These additional services make Finom a comprehensive solution for sole traders who want to organize their financial processes efficiently and digitally.

A business account for individual entrepreneurs with German IBAN.

Connect all your other online banking accounts to Finom. Access all your wallets, transactions, account statements, and tax assessments across several banks on a single platform. You can even delete those bank apps altogether

Use your business account to manage team expenses and enhance your financial planning

Subscription plans at a fair cost tailored to fit your business.

For freelancers who need simple, essential features

For individual entrepreneurs or small teams taking their first steps. Simple, essential tools to start and stay in control

For small to medium-sized businesses with straightforward needs. Flexible tools and higher limits for daily operations

Business account

Business account

Business account

Users included

1

Users included

2

Users included

Cashback

0%

Cashback

1%

Cashback

3%

AI Assistant

AI Assistant

AI Assistant

Chat support

Up to 1 business day

Chat support

Up to 3 hours

Chat support

Up to 3 minutes

Account Manager

Account Manager

Account Manager

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Monthly interest rate

1% - 1,7%

Monthly interest rate

1% - 1,7%

Monthly interest rate

1% - 1,7%

Credit line maintenance per day

€1

Credit line maintenance per day

€1

Credit line maintenance per day

€0,5

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€2 500

Free outgoing SEPA transfers

€25 000

Free outgoing SEPA transfers

€50 000

Free VISA physical cards per user

0

Free VISA physical cards per user

1

Free VISA physical cards per user

3

Free VISA virtual cards per user

1

Free VISA virtual cards per user

3

Free VISA virtual cards per user

10

Outgoing international payments

1%

Outgoing international payments

0.50%

Outgoing international payments

0.40%

Role and user management

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Bulk payments

For individual entrepreneurs or small teams taking their first steps. Simple, essential tools to start and stay in control

For small to medium-sized businesses with straightforward needs. Flexible tools and higher limits for daily operations

For small to medium-sized businesses ready to scale. The flexibility to grow with advanced features and higher limits

Business account

Business account

Business account

Users included

2

Users included

Users included

Cashback

1%

Cashback

3%

Cashback

unlimited cashback up to 0,5%

AI Assistant

AI Assistant

AI Assistant

Chat support

Up to 3 hours

Chat support

Up to 3 minutes

Chat support

Up to 3 minutes

Account Manager

Account Manager

Account Manager

Account Management team

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Monthly interest rate

1% - 1,7%

Monthly interest rate

1% - 1,7%

Monthly interest rate

1% - 1,7%

Credit line maintenance per day

€1

Credit line maintenance per day

€0,5

Credit line maintenance per day

€0,5

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€25 000

Free outgoing SEPA transfers

€50 000

Free outgoing SEPA transfers

€100 000

Free VISA physical cards per user

1

Free VISA physical cards per user

3

Free VISA physical cards per user

3

Free VISA virtual cards per user

3

Free VISA virtual cards per user

10

Free VISA virtual cards per user

Outgoing international payments

0.50%

Outgoing international payments

0.40%

Outgoing international payments

0.20%

Role and user management

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Bulk payments

For small to medium-sized businesses ready to scale. The flexibility to grow with advanced features and higher limits

For small to medium-sized businesses scaling at speed. Our most comprehensive package with concierge-level support and full customization

Business account

Business account

Users included

Users included

Cashback

unlimited cashback up to 0,5%

Cashback

unlimited cashback up to 1%

AI Assistant

AI Assistant

Chat support

Up to 3 minutes

Chat support

Up to 3 minutes

Account Manager

Account Management team

Account Manager

Dedicated Account Manager

Credit products

Provided by Finom Growth B.V.

Credit products

Provided by Finom Growth B.V.

Monthly interest rate

1% - 1,7%

Monthly interest rate

1% - 1,7%

Credit line maintenance per day

€0,5

Credit line maintenance per day

€0,5

Payment Solutions

Provided by Finom Payments/Solaris SE

Payment Solutions

Provided by Finom Payments/Solaris SE

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€100 000

Free outgoing SEPA transfers

Free VISA physical cards per user

3

Free VISA physical cards per user

3

Free VISA virtual cards per user

Free VISA virtual cards per user

Outgoing international payments

0.20%

Outgoing international payments

0.10%

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Our servers are protected and hosted in the European Union

To minimize risks, we’ve partnered with one of the largest multinational banks, BNP Paribas, to hold your funds

We have a separate Safeguarding Foundation supervised by the DNB to manage your money

Your money is protected with secure passwordless authentication and single-use passwords

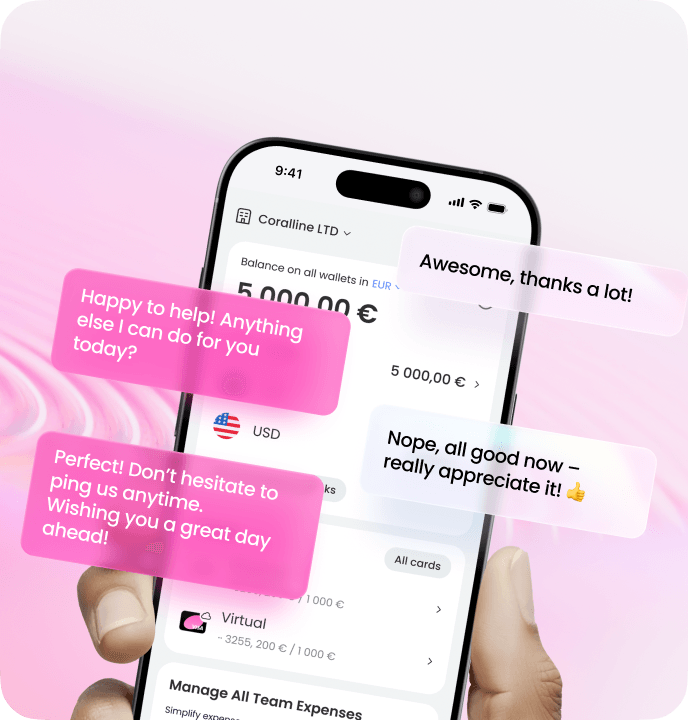

Help is just a click away

Interactive Help Center available 24 hours

24/7

Fast response time

Contact us on e-mail: hello@finom.co

A business account is usually the better choice for sole traders. Although there is no legal obligation to use a business account, the business use of a private account is not permitted by many banks according to their general terms and conditions.

A business account offers clear advantages:A private account can be sufficient for very low business volumes, but is impractical in the long term and can lead to problems with the bank or tax office. A business account is therefore the professional and secure solution.

Plan configurator

1 / 4