A new accounting era

The only power tool your business needs, built straight into your business bank account. Start for free today.

All-in-one accounting workflow

Scan receipts Snap a photo and get it instantly recognized

Reconcile transactions Documents perfectly auto-matched to their transactions

Categorize with AI Smart categorization with automatic VAT, even for Reverse Charge

Create invoices 100% compliant e-invoices, created in a couple of clicks

Submit reports UStVA, UStE, EÜR, GewSt, ZM, ready for filing in seconds

Documents and reports can be straightforward

Tools to simplify your accounting

Built-in and truly seamless, they handle the heavy lifting while you stay in control

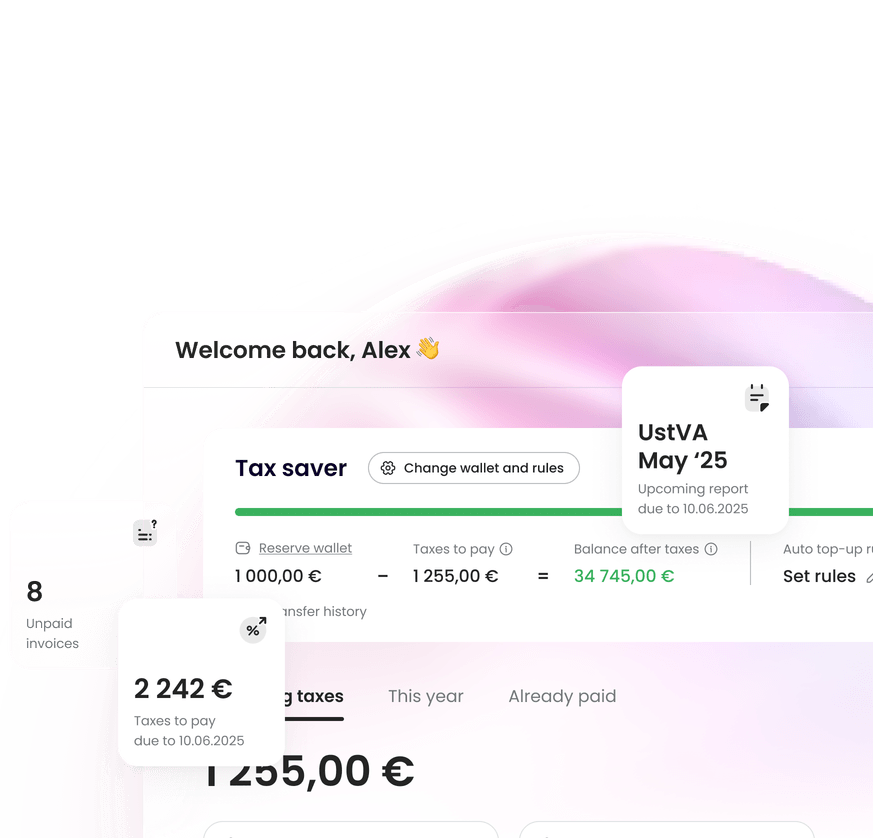

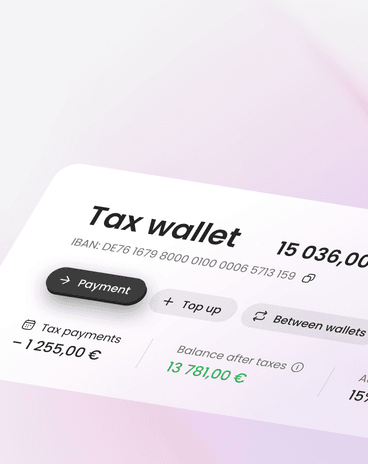

Smart tax wallet

Our system reminds you to reserve funds for your taxes in real time

You decide. Always

The algorithm suggests. You approve or disapprove

Integrations that work

Export to DATEV, WISO, Lexware, Sevdesk, and BuchhaltungsButler

Reconciliation on autopilot

Mistakes flagged for your review before they become problems

Bookkeeping & Tax payments effortless and always on time

The algorithm calculates the taxes you owe and reminds you to set it aside

Always be prepared

See exactly what you owe and confirm you've saved enough

Enjoy general deduction tips

Get general guidance on what expenses may be deductible

Automatically calculate totals

Handle your taxes better

Be Finanzamt-ready

Generate and send reports in minutes

Your data is protected at all times

GDPR-compliant

Your data is encrypted and never leaves the European Union

AI Act-ready

Finom fully complies with the newly issued EU AI Act

Human validation

You can always request a certified tax advisor to review your entries

Passkeys and 3D Secure

Your money is protected by state-of-art measures

Simple, transparent pricing

FAQ

Who is this service for?

Finom AI Accounting is available for all ‘Einzelunternehmer’ in Germany – both ‘Gewerbetreibender’ and freelancers. ‘UG’, ‘GmbH’, ‘GbR’, and other companies can currently submit ‘Ust’ reports; other company report types are in development.What services are included?

The platform categorizes expenses, recognizes and fully processes documents, and generates essential reports, including ‘UstVA’ & ‘UstE’, ‘EÜR’, ‘GeSt’, ‘ESt’, and ‘ZM’. With the Tax Wallet feature, you can even set up automatic tax savings.Can I try it for free and cancel after?

Click "Start free now" and answer a few short questions about your business. This helps us tailor your experience and provide the best service from day one.Do I need accounting knowledge to use Finom AI Accounting?

Not at all. Our platform is intuitive and guides you step by step with minimal input. Whether you’re completely new to accounting or already experienced, it adapts to your level and needs.Can I use it without a VAT number?

Yes. Finom works for all freelancers and small businesses, whether or not they charge VAT. The platform adapts to your situation for smooth financial management regardless of your VAT status.How does bank integration work?

All payments made through your Finom business account are automatically recorded in your accounting. You can also import transactions from other banks via the ‘Multibanking’ feature for seamless syncing.Is my confidential financial data safe?

Absolutely. Your data is encrypted and handled in full compliance with ‘GDPR’ and the highest data protection standards.Does Finom integrate with other tools?

Yes, Finom seamlessly integrates with popular accounting platforms, invoicing tools, and tax systems. You can send data to ‘DATEV’, ‘lexoffice’, ‘sevdesk’, ‘Finanzamt’, and other services, making it easier to sync all your financial data in one place. See the full list here:I have an idea or suggestion for Finom Accounting. How can I share it?

We’d love to hear from you! Send your feedback to accounting@finom.co – it helps us make AI Accounting even more tailored and helpful.How does Finom Accounting differ from other solutions like tax advisors or other accounting tools?

Finom AI Accounting takes a proactive approach to bookkeeping. It automatically checks your transactions and notifies you if an invoice is missing, ensuring all necessary documents are in place. Before tax deadlines, it verifies that your reports are ready for direct submission. Unlike traditional tax advisors, AI Accounting automates routine tasks like document recognition, expense categorization, and report generation, saving time and reducing manual work. Compared to other accounting tools, it adds unique features like a built-in AI assistant for financial guidance, a tax savings account, and a tax calendar for easier and more efficient tax management.