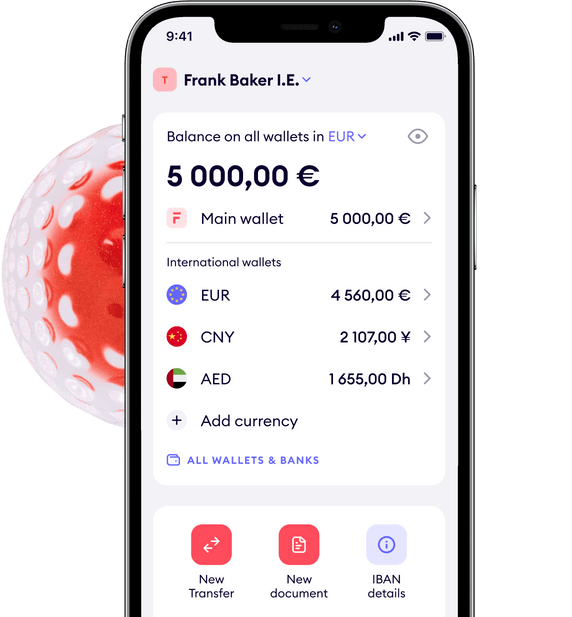

Fearlessly transfer large amounts

Intuitively easy processes eliminate stress and any kind of mistakes

- Transparent rates, one mark-up for all currencies. No matter the amount

- Real-time rates to exchange money in the most favorable moment

- No forced conversion or sum limits on exchange or transfers

- All fees clearly shown in advance of any transaction