Get the easiest financial tool for the self-employed

Open a fully functional free Solo account for freelancers. Get a local IBAN in 24 hours and use convenient invoicing tools

Thinking of starting a business? Get self-employed status for free and start working right away – 100% online.

Open a fully functional free Solo account for freelancers. Get a local IBAN in 24 hours and use convenient invoicing tools

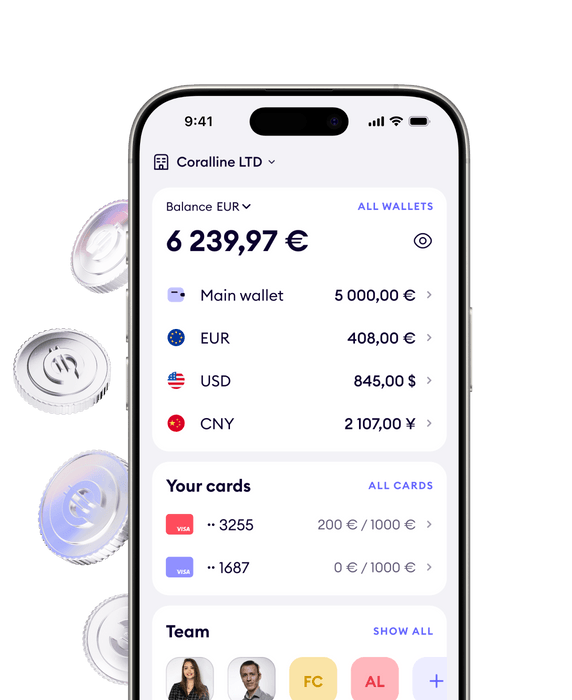

Physical and virtual cards for every project

Simple, powerful – built to get you paid twice as fast

Register your business without queues, paperwork, and face-to-face appointments. Get ready to start your business in hours.

Your money is in safe hands because we strive to provide a high level of security to protect it:

For accounts operating under Finom’s own license, there are also legal regulatory measures of the institution providing your business account in addition to the security measures on the Finom platform and applications provided by PNL Fintech B.V., i.e. Safeguarding your account via Finom Payments B.V.:

For more information, please refer to the Terms of Finom Payments.

For accounts operating under Solaris license, there are also legal regulatory measures of the institution providing your business account in addition to the security measures on the Finom platform and applications, i.e. German Deposit Guarantee Scheme (DGS), where your money may be protected for up to €100,000 via Solaris SE and not PNL Fintech B.V. For more information, please refer to the Terms of Solaris SE.

Plan configurator

1 / 4