Business account with no bureaucracy. Enjoy 3 months free!

Get an Italian IBAN in 24h. Send invoices and F24s in seconds. Enjoy human support a message away — all in one app for entrepreneurs.

Account built for businesses in Italy

Less repetitive work. More local essentials and automation so your business runs on ease.

F24 Ordinario/Accise Pay taxes directly from your Finom account. Records tax-ready – no more stress about deadlines or errors.

Built-in e-invoicing Send custom invoices, get paid up to 20% faster, enjoy auto-matched receipts. Everything syncs beautifully.

PagoPA Coming soonSettle fees and public payments in seconds without leaving your Finom account – it’s all integrated.

MAV/RAV Coming soonManage payslips for your team, suppliers, and partners without the runaround.

00

days

00

hrs

00

mins

00

secs

Test drive Finom. 3 months for FREE.

Sign up today and enjoy the Basic or Smart plan free of charge for 3 months.

Users includedup to ∞

Cashbackup to 3%

ATM withdrawal limitup to € 5 000

Card payment limitup to € 100 000

Virtual cards includedup to 10 per user

Physical cards includedup to 3 per user

Free outgoing SEPA transfersup to € 50 000

Business flows better with Finom

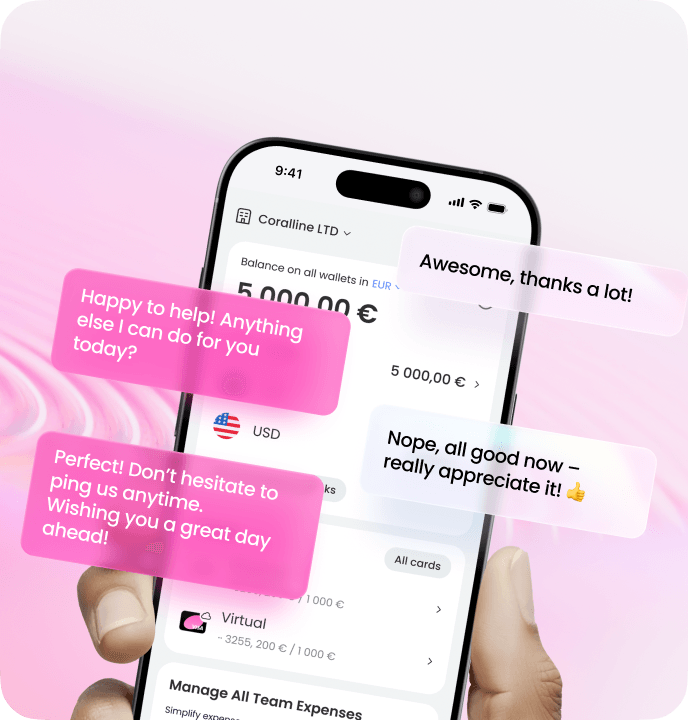

All essentials for your daily finance in one sleek, intuitive mobile app — no switching tools or tabs, no extra work.

Pay anywhere

with ApplePay or GooglePay

Exceptional up to

cashback

Free VISA cards. Physical and virtual.

EU transfers under control

24/7

in 10 seconds

Control on the go

All finances in one secure place

International payments to 150+ countries

200K+ EU businesses can’t be wrong

They came for the features and stayed for the peace of mind. Read authentic reviews from our real customers.

Fair pricing, tailored to you

Flexible plans that fit your business needs today, not the other way around.

For freelancers who need simple, essential features

For individual entrepreneurs or small teams taking their first steps. Simple, essential tools to start and stay in control

For small to medium-sized businesses with straightforward needs. Flexible tools and higher limits for daily operations

Business account

Business account

Business account

Users included

1

Users included

2

Users included

Cashback

0%

Cashback

1%

Cashback

3%

AI Assistant

AI Assistant

AI Assistant

Chat support

Up to 1 business day

Chat support

Up to 3 hours

Chat support

Up to 3 minutes

Account Manager

Account Manager

Account Manager

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€2 500

Free outgoing SEPA transfers

€25 000

Free outgoing SEPA transfers

€50 000

Free VISA physical cards per user

0

Free VISA physical cards per user

1

Free VISA physical cards per user

3

Free VISA virtual cards per user

1

Free VISA virtual cards per user

3

Free VISA virtual cards per user

10

Outgoing international payments

1%

Outgoing international payments

0.50%

Outgoing international payments

0.40%

Role and user management

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Bulk payments

For individual entrepreneurs or small teams taking their first steps. Simple, essential tools to start and stay in control

For small to medium-sized businesses with straightforward needs. Flexible tools and higher limits for daily operations

For small to medium-sized businesses ready to scale. The flexibility to grow with advanced features and higher limits

Business account

Business account

Business account

Users included

2

Users included

Users included

Cashback

1%

Cashback

3%

Cashback

unlimited cashback up to 0,5%

AI Assistant

AI Assistant

AI Assistant

Chat support

Up to 3 hours

Chat support

Up to 3 minutes

Chat support

Up to 3 minutes

Account Manager

Account Manager

Account Manager

Account Management Team

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€25 000

Free outgoing SEPA transfers

€50 000

Free outgoing SEPA transfers

€100 000

Free VISA physical cards per user

1

Free VISA physical cards per user

3

Free VISA physical cards per user

3

Free VISA virtual cards per user

3

Free VISA virtual cards per user

10

Free VISA virtual cards per user

Outgoing international payments

0.50%

Outgoing international payments

0.40%

Outgoing international payments

0.20%

Role and user management

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Bulk payments

For small to medium-sized businesses ready to scale. The flexibility to grow with advanced features and higher limits

For small to medium-sized businesses scaling at speed. Our most comprehensive package with concierge-level support and full customization

Business account

Business account

Users included

Users included

Cashback

unlimited cashback up to 0,5%

Cashback

unlimited cashback up to 1%

AI Assistant

AI Assistant

Chat support

Up to 3 minutes

Chat support

Up to 3 minutes

Account Manager

Account Management Team

Account Manager

Dedicated Account Manager

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€100 000

Free outgoing SEPA transfers

Free VISA physical cards per user

3

Free VISA physical cards per user

3

Free VISA virtual cards per user

Free VISA virtual cards per user

Outgoing international payments

0.20%

Outgoing international payments

0.10%

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Compare plans

All-in-one Business Platform

Solo

BasicPromo

SmartPromo

Business Account

Personal IBAN (unique account number for global transfers)

Multiaccounts

Cashback

0%

1%

3%

Users included

1

2

Expense management

Team cards personalization

AI assistant

Chat support

Up to 1 business day

Up to 3 hours

Up to 3 minutes

Email support

Up to 1 business day

Up to 3 hours

Up to 30 minutes

Weekend support

Account Manager

Provided by Finom Payments

SEPA payments

Transfers between Finom's users in a few seconds

Extra SEPA OUT & Direct Debit transfers (per month)

€0 - €2 500

0%

0%

0%

€2 500 - €10 000

0.30%

0%

0%

€10 000 - €25 000

0.30%

0%

0%

€25 000 - €50 000

0.30%

0.03%

0%

€50 000 - €100 000

0.30%

0.03%

0.025%

€100 000 +

0.30%

0.03%

0.025%

SEPA Instant transfers

Decline of Direct Debit

5 €

5 €

5 €

Scheduled payments

Bulk payments

Card payments

Free physical cards

0

1 per user

3 per user

Physical card monthly maintenance

€3

€0

€0

Monthly card payment limit

€100 000

€100 000

€100 000

Monthly ATM withdrawal limit

€500

€1 500

€2 000

Card payments in foreign currency (non-EUR)

€0 - €500

3%

0%

0%

€500 - €1 000

3%

2%

1%

€1 000 +

3%

2%

1%

ATM withdrawals in foreign currency (non-EUR)

3%

2%

1%

Card payments for certain MCCs (%, minimum 1 €)

€0 - €500

3%

2%

1 %

€500 - €2 500

4%

3%

2%

€2 500 - €5 000

5%

4%

3%

€5 000 +

6%

5%

4%

ATM withdrawal amounts (applicable for all cards)

€0 - €500

1%

0%

0%

€500 - €2 000

3%

1%

0%

€2 000 - €5 000

5%

5%

3%

€5 000 - €10 000

8%

8%

5%

€10 000 +

8%

8%

8%

Monthly fee for the inactive physical card

€0

€1

€0

Virtual cards

1 per user

3 per user

10 per user

Monthly fee for virtual VISA Card

€0

€0

€0

Monthly fee for the inactive virtual card

€1

€0,5

€0

Free card express delivery

Basic card limits management

Advanced card limits management

Special offers

International payments

Incoming international payments (fee per payment)

5 €

5 €

5 €

Outgoing international payments (fee per payment)

5 €

5 €

5 €

Fee for the outgoing volume of international payments

1%

0.50%

0.40%

Coverage of the International transfer cost, optional

35 €

35 €

35 €

Local payments

F24 Ordinario/Accise

€0

€0

€0

MAV

coming soon

coming soon

coming soon

RAV

coming soon

coming soon

coming soon

PagoPA

coming soon

coming soon

coming soon

Accounting & Invoicing

Accounting integrations up to 30 tools (Sage, FreshBooks, Netsuite, etc.)

Reconciliation of invoices and receipts

Recognition of invoices and receipts

Role and user management

Customization of invoice templates

Visual analytics of income and expenses

Additional fees for special services

Express delivery of Finom Card

€15

€15

Reference letter fee for business

€80

€80

€80

Business Account Closure Refund Processing Fee

€5

€5

€5

Recall of outgoing SEPA SCT

€15

€15

€15

Inquiry on SEPA SCT (Payment Investigation)

€15

€15

€15

Recall of international payments

€60

€60

€60

Outgoing payment investigation

Incoming payment investigation

Fee for providing MT103

€20

€20

€20

Fee for MT199 request

€45

€45

€45

Audit confirmation statement

€100

€100

€100

Refusal to redeem an authorized direct debit due to insufficient account balance

€1

€1

€1

Unarranged negative balance on Finom Business Account

€1 per day

€1 per day

€1 per day

Dunning letter (per letter)

€5

€5

€5

Card dispute for an authorised transaction (per transaction)

€15

€15

€15

Administrating irregularities applied to the Finom Business Account

€25

€25

€25

Personal account manager

Onboarding fee

Applied individually

Applied individually

Applied individually

Compliance fee

Please note that certain services are directly provided to you by a payment institution. Finom charges you for the platform services.

For our detailed price list, download PDF here

BasicPromo

SmartPromo

ProYou save € 360

Business Account

Personal IBAN (unique account number for global transfers)

Multiaccounts

Cashback

1%

3%

unlimited cashback up to 0,5%

Users included

2

Expense management

Team cards personalization

AI assistant

Chat support

Up to 3 hours

Up to 3 minutes

Up to 3 minutes

Email support

Up to 3 hours

Up to 30 minutes

Up to 30 minutes

Weekend support

Account Manager

Account Management Team

Provided by Finom Payments

SEPA payments

Transfers between Finom's users in a few seconds

Extra SEPA OUT & Direct Debit transfers (per month)

€0 - €2 500

0%

0%

0%

€2 500 - €10 000

0%

0%

0%

€10 000 - €25 000

0%

0%

0%

€25 000 - €50 000

0.03%

0%

0%

€50 000 - €100 000

0.03%

0.025%

0%

€100 000 +

0.03%

0.025%

0.025%

SEPA Instant transfers

Decline of Direct Debit

5 €

5 €

5 €

Scheduled payments

Bulk payments

Card payments

Free physical cards

1 per user

3 per user

3 per user

Physical card monthly maintenance

€0

€0

€0

Monthly card payment limit

€100 000

€100 000

€100 000

Monthly ATM withdrawal limit

€1 500

€2 000

€5 000

Card payments in foreign currency (non-EUR)

€0 - €500

0%

0%

0%

€500 - €1 000

2%

1%

1%

€1 000 +

2%

1%

1%

ATM withdrawals in foreign currency (non-EUR)

2%

1%

1%

Card payments for certain MCCs (%, minimum 1 €)

€0 - €500

2%

1 %

1 %

€500 - €2 500

3%

2%

1%

€2 500 - €5 000

4%

3%

2%

€5 000 +

5%

4%

3%

ATM withdrawal amounts (applicable for all cards)

€0 - €500

0%

0%

0%

€500 - €2 000

1%

0%

0%

€2 000 - €5 000

5%

3%

3%

€5 000 - €10 000

8%

5%

5%

€10 000 +

8%

8%

8%

Monthly fee for the inactive physical card

€1

€0

€0

Virtual cards

3 per user

10 per user

Monthly fee for virtual VISA Card

€0

€0

€0

Monthly fee for the inactive virtual card

€0,5

€0

€0

Free card express delivery

Basic card limits management

Advanced card limits management

Special offers

International payments

Incoming international payments (fee per payment)

5 €

5 €

5 €

Outgoing international payments (fee per payment)

5 €

5 €

5 €

Fee for the outgoing volume of international payments

0.50%

0.40%

0.20%

Coverage of the International transfer cost, optional

35 €

35 €

35 €

Local payments

F24 Ordinario/Accise

€0

€0

€0

MAV

coming soon

coming soon

coming soon

RAV

coming soon

coming soon

coming soon

PagoPA

coming soon

coming soon

coming soon

Accounting & Invoicing

Accounting integrations up to 30 tools (Sage, FreshBooks, Netsuite, etc.)

Reconciliation of invoices and receipts

Recognition of invoices and receipts

Role and user management

Customization of invoice templates

Visual analytics of income and expenses

Additional fees for special services

Express delivery of Finom Card

€15

Reference letter fee for business

€80

€80

€80

Business Account Closure Refund Processing Fee

€5

€5

€5

Recall of outgoing SEPA SCT

€15

€15

€15

Inquiry on SEPA SCT (Payment Investigation)

€15

€15

€15

Recall of international payments

€60

€60

€60

Outgoing payment investigation

€45

Incoming payment investigation

€50

Fee for providing MT103

€20

€20

€20

Fee for MT199 request

€45

€45

€45

Audit confirmation statement

€100

€100

€100

Refusal to redeem an authorized direct debit due to insufficient account balance

€1

€1

€1

Unarranged negative balance on Finom Business Account

€1 per day

€1 per day

€1 per day

Dunning letter (per letter)

€5

€5

€5

Card dispute for an authorised transaction (per transaction)

€15

€15

€15

Administrating irregularities applied to the Finom Business Account

€25

€25

€25

Personal account manager

Onboarding fee

Applied individually

Applied individually

Applied individually

Compliance fee

Applied individually

Please note that certain services are directly provided to you by a payment institution. Finom charges you for the platform services.

For our detailed price list, download PDF here

ProYou save € 360

GrowYou save € 1,080

Business Account

Personal IBAN (unique account number for global transfers)

Multiaccounts

Cashback

unlimited cashback up to 0,5%

unlimited cashback up to 1%

Users included

Expense management

Team cards personalization

AI assistant

Chat support

Up to 3 minutes

Up to 3 minutes

Email support

Up to 30 minutes

Up to 30 minutes

Weekend support

Account Manager

Account Management Team

Dedicated Account Manager

Provided by Finom Payments

SEPA payments

Transfers between Finom's users in a few seconds

Extra SEPA OUT & Direct Debit transfers (per month)

€0 - €2 500

0%

0%

€2 500 - €10 000

0%

0%

€10 000 - €25 000

0%

0%

€25 000 - €50 000

0%

0%

€50 000 - €100 000

0%

0%

€100 000 +

0.025%

0%

SEPA Instant transfers

Decline of Direct Debit

5 €

5 €

Scheduled payments

Bulk payments

Card payments

Free physical cards

3 per user

3 per user

Physical card monthly maintenance

€0

€0

Monthly card payment limit

€100 000

€200 000

Monthly ATM withdrawal limit

€5 000

€5 000

Card payments in foreign currency (non-EUR)

€0 - €500

0%

0%

€500 - €1 000

1%

1%

€1 000 +

1%

1%

ATM withdrawals in foreign currency (non-EUR)

1%

1%

Card payments for certain MCCs (%, minimum 1 €)

€0 - €500

1 %

1 %

€500 - €2 500

1%

1%

€2 500 - €5 000

2%

2%

€5 000 +

3%

3%

ATM withdrawal amounts (applicable for all cards)

€0 - €500

0%

0%

€500 - €2 000

0%

0%

€2 000 - €5 000

3%

3%

€5 000 - €10 000

5%

5%

€10 000 +

8%

8%

Monthly fee for the inactive physical card

€0

€0

Virtual cards

Monthly fee for virtual VISA Card

€0

€0

Monthly fee for the inactive virtual card

€0

€0

Free card express delivery

Basic card limits management

Advanced card limits management

Special offers

International payments

Incoming international payments (fee per payment)

5 €

5 €

Outgoing international payments (fee per payment)

5 €

5 €

Fee for the outgoing volume of international payments

0.20%

0.10%

Coverage of the International transfer cost, optional

35 €

35 €

Local payments

F24 Ordinario/Accise

€0

€0

MAV

coming soon

coming soon

RAV

coming soon

coming soon

PagoPA

coming soon

coming soon

Accounting & Invoicing

Accounting integrations up to 30 tools (Sage, FreshBooks, Netsuite, etc.)

Reconciliation of invoices and receipts

Recognition of invoices and receipts

Role and user management

Customization of invoice templates

Visual analytics of income and expenses

Additional fees for special services

Express delivery of Finom Card

Reference letter fee for business

€80

€80

Business Account Closure Refund Processing Fee

€5

€5

Recall of outgoing SEPA SCT

€15

€15

Inquiry on SEPA SCT (Payment Investigation)

€15

€15

Recall of international payments

€60

€60

Outgoing payment investigation

€45

€45

Incoming payment investigation

€50

€50

Fee for providing MT103

€20

€20

Fee for MT199 request

€45

€45

Audit confirmation statement

€100

€100

Refusal to redeem an authorized direct debit due to insufficient account balance

€1

€1

Unarranged negative balance on Finom Business Account

€1 per day

€1 per day

Dunning letter (per letter)

€5

€5

Card dispute for an authorised transaction (per transaction)

€15

€15

Administrating irregularities applied to the Finom Business Account

€25

€25

Personal account manager

Onboarding fee

Applied individually

Applied individually

Compliance fee

Applied individually

Applied individually

Please note that certain services are directly provided to you by a payment institution. Finom charges you for the platform services.

For our detailed price list, download PDF here

Customer support, providing real-time care

Help is just a click away

Interactive Help Center available 24 hours

24/7

Fast response time

Contact us on e-mail: hello@finom.co

Security is our top priority

GDPR Compliance

Our servers are protected and hosted in the European Union

Reliable partners

To minimize risks, we’ve partnered with one of the largest multinational banks, BNP Paribas, to hold your funds

Safeguarded funds: unlimited

We have a separate Safeguarding Foundation supervised by the DNB to manage your money

Passkeys and 3D Secure

Your money is protected with secure passwordless authentication and single-use passwords

FAQ

Who can use the business account for free for 3 months?

The promotion applies to all Finom customers who open a Business Account between October 29 and November 30, 2025. The offer is valid only for the Basic and Smart plans.What do I need to do to join the promotion?

Select your preferred business account plan (Basic or Smart) and start the onboarding process. The offer will be applied automatically if you sign up during the promotional period.What happens after the promotional period ends?

Unless you cancel or switch plans, the regular monthly subscription fee will apply after three months.What if I realize I need higher limits or more users? Can I upgrade?

Yes, you can upgrade your plan at any time. However, the promotion is only valid for the Basic and Smart plans.Are all features free during the promotion?

For three months from the activation date, you will not pay any fees for your chosen plan – the business account itself will be free of charge. However, additional transaction or service fees may apply.What is Finom?

Finom is a European fintech company built for entrepreneurs and small to medium-sized enterprises. We believe that small businesses are the foundation of the European economy, so our goal is to simplify the lives of those who provide for half of Europe. We came to bring the technologies of the future to business management processes for entrepreneurs, enabling them to spend their resources where it matters the most: on their businesses and themselves. That’s why we combined all these different financial services, such as accounting, financial management, and a business account, into one convenient solution. Early-stage businesses can sign up for an online account within minutes and immediately enjoy our features’ advantages via our mobile and web apps.Do I get an Italian IBAN?

Yes, you will! Finom has a license that allows customers to receive an Italian IBAN.How does a Finom business account differ from a traditional bank account?

Finom is a fintech company and NOT a bank. Finom allows you to access some services associated with traditional banking, such as payments, withdrawals, and cards, but in the fastest and smartest way. With Finom, you can set up a business account in a few seconds, check your balance on the go, get cashback of up to 3%, create and send invoices, rely on real-time customer support, delegate tasks to team members, monitor your expenses and incomes, and have them categorized according to your habits.Can I make SEPA and international transfers with Finom (like SWIFT or similar)?

Yes, Finom allows you to send payments within the SEPA zone and international payments worldwide.Is Finom secure?

Absolutely! We use advanced anti-fraud techniques, double encryption, and the TLS protocol to protect your personal and transfer data. Your finances are in safe hands with Finom – here, you can read more about our security policy.Which legal forms does Finom support in Italy?

Currently, we accept Italian companies with the following legal forms:- Ditta Individuale

- Libero professionista

- Società in nome collettivo (SNC)

- Società Semplice (SS)

- Società a responsabilità limitata (SRL)

- Società consortile a responsabilità limitata (SCARL)

- Società a responsabilità limitata semplice (SRLS)

- Società europea (SE)

- Società in accomandita per azioni (SAPA)

- Società in accomandita semplice (SAS)

- Società per azioni (SPA)

- Società Consortile per Azioni (SCPA)