PO vs. invoice: both documents deal with similar things and have a lot in common. These are official, legally binding documents that include details of the financial activity of the entity. Both are used to conclude a payment agreement; both can be mailed or sent digitally. A purchase order indicates a purchase, hence, the name, while an invoice indicates a sale.

Navigating the world of finance is a complicated process. There are so many financial terms and documents that even people with solid experience in the field sometimes feel baffled. One of the most common disambiguations emerges when it comes to specifying the differences between purchase orders (POs) and invoices.

This article outlines the purpose and nuances of these two financial documents that play an essential role in maintaining a stable cash flow, thus keeping a business afloat.

What Is a Purchase Order?

A purchase order (PO) is an official document that confirms the placement of an order by a purchaser and imposes certain obligations on a vendor. The process is quite simple: a buyer orders products or services and then sends a PO to a seller that authorizes a purchase. Once a merchant accepts the agreement, a purchase order becomes a legally binding document. Even a basic purchase order usually contains a good deal of information, such as:

- Purchase date

- Delivery date

- Purchase order (PO) number

- Order description

- Order price

- Purchaser name

- Shipping address (address of the purchaser)

- Seller name

- Billing address (address of the seller)

- General terms and conditions

- Payment terms

- Issuing authority’s signature.

Purchase Request Forms

Purchase orders are often confused with purchase requisitions, also known as purchase request forms. They do have some things in common; however, these two financial documents have a significant difference. Purchase requisitions are mainly used by large companies to place orders with the purchasing department. Once the purchasing department receives the order from an employee, it then supervises product delivery from an outside merchant. So, the main difference is that a purchase requisition is used to process orders internally by the department in charge of procurement. Purchase request forms are rarely used by small businesses.

What Is a PO Number?

A PO number is a unique identification number assigned both to the purchase order and the supplier invoice. It helps ensure the seller ships precisely the same products or services ordered by a buyer and simplifies the process of matching the invoice to the corresponding purchase order.

A purchase order number is always mentioned on an invoice, so a seller should charge the right amount for the item. A buyer, in turn, can match the number on the invoice to the purchase order number to check if they are paying for the right product.

Types of Purchase Orders

Procurement management is a vital part of any successful business, small or large. Suppose your enterprise does not fine-tune a coherent process for managing procurement. In that case, there is a high risk of a loss caused by costly purchasing mistakes. POs can undoubtedly help you minimize unnecessary expenditures; however, you should be aware of the main types of purchase orders employed for this purpose.

- Standing Purchase Order. Standing purchase orders are used when your long-term buyers need to line up recurring purchases frequently. Standing POs allow the ordering of the same goods or services multiple times within a specific time period, using the same purchase order number.

- Blanket Purchase Order. Blanket POs are drawn up when the ordering party needs to arrange multiple deliveries for an agreed-upon price over a set time frame. Blanket purchase orders are generally used in the B2B sphere and are often offered with discounts or other incentives.

How Are Purchase Orders Used?

POs are efficient financial tools that are used to track order statuses and manage suppliers’ payments. Some purchase orders may also implicate preliminary provisions that the parties (the buyer and the seller) have agreed upon before the purchase. These provisions could include any arrangements - from shipping goods with all-cargo services to paying for the order in a cryptocurrency.

Purchase orders provide sellers with information such as the number of products to deliver to the buyer and the payment date to receive from the customer. Take some time to bring your PO database in order and manage it wisely. It will become a powerful instrument that will help you with the following things:

- Staying informed regarding how many goods you have sold to a particular customer;

- Keeping track of payment due dates;

- Facilitating the reordering of inventory from your manufacturer;

- Preventing overstocking of the inventory;

- Averting orders being mixed up;

- Ensuring the timely delivery of orders to purchasers

- PO for invoice. A purchase order helps make a correct invoice.

What Are the Benefits of Purchase Orders?

The itemized nature of purchase orders makes them an effective management tool for both small businesses and giant companies. Here are some substantial benefits you can yield by implementing POs into your business system:

- Establishment of a clear framework. A PO sets certain requirements for the vendors and makes them clear to follow.

- Prevention of duplicate orders. POs help monitor the number of incoming requests. If the order request volume suddenly increases, it’s crucial to ensure your order system works properly. With a purchase order, you can perform a quick check on the number of orders placed by a customer, thus, avoiding delivering duplicate orders, which may cause a huge loss to your business.

- Avoidance of cost overruns. A PO serves as proof of the agreed-upon pricing struck between you and a specific supplier or manufacturer. If that manufacturer changes their price, refer to the relevant PO to point out the initial cost. This way, your accounts payable is under the protection of the respective purchase order.

- Detection of performance issues. Analyzing POs can be helpful when it comes to specifying which orders boost the growth of your business and which ones are causing significant losses without bringing much value. Provided with these insights, you have an opportunity to manage your venture strategically.

- Effective inventory management. Use special software to keep your purchase order system tidy, as with clear inventory visibility; you will be able to determine when to replenish the stock and streamline the workflow.

What Is an Invoice?

An invoice is a financial document issued either by the seller or the supplier of goods. It serves as an instrument to solicit payments and keep track of business transactions. Invoices are sent out when the terms of a corresponding PO have been fulfilled, e.g., upon delivery of a physical product to the client or when a service was provided.

Invoices usually go hand in hand with purchase orders, as both documents specify the exact amount owed to the seller. Invoices are often referred to as “statements,” “sales invoices,” or “bills.” An invoice is always created in response to the respective PO, even if the order was settled informally. In other words, purchase orders go first, then invoices come later.

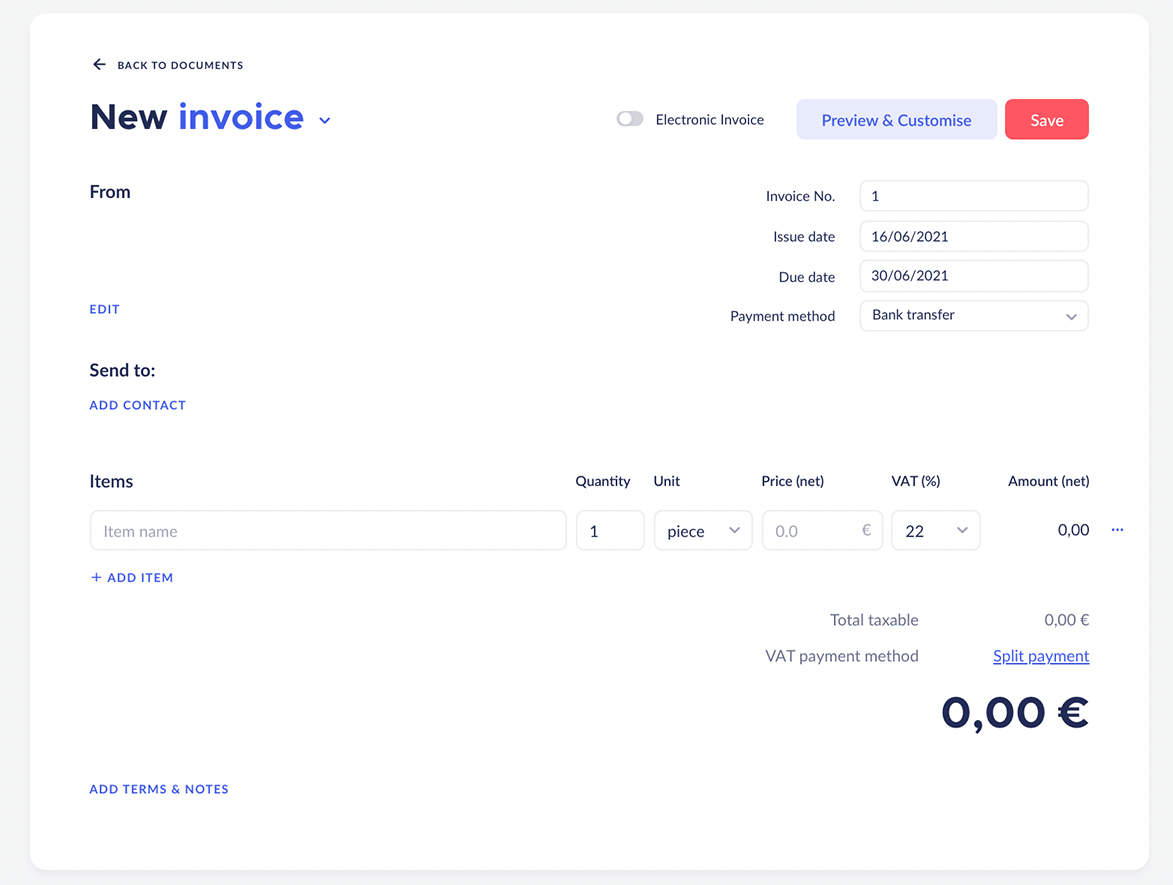

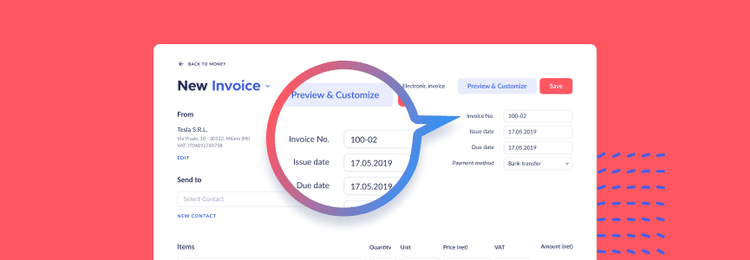

No matter what your company supplies: virtual products, tangible goods, online or offline services, basic invoice templates should include the following information:

- Invoice date

- Invoice number

- Purchase order number

- Order description

- The price of each item ordered

- Purchaser name

- Shipping address (address of the purchaser)

- Seller name

- Billing address (address of the seller)

- Total amount due

- Taxes (if there are any)

- Discounts (if there are any)

- Payment terms

- Seller signature.

- Learn how to write a proper invoice and find out what it should contain in more detail in this article.

Types of Invoices

A vendor can issue various types of invoices. Trying to figure out which kind of invoice you need is quite an overwhelming procedure. You should take into account such factors as your field of activity, billing documents in use, and payment plans offered to your clients. In addition to the standard invoices, there are at least three types you should consider to run a successful business.

- Sales Invoices. A sales invoice is generally issued by the vendor to the buyer once the ordered products are delivered. A sales invoice aims to provide details on the specific product, the number of items ordered, and other important information, such as the shipping method or payment due date. A sales invoice is a legally binding financial document that serves as an official request for payment.

- Purchase Invoices. The term "purchase invoice" is not commonly used because it shares identical characteristics and functions with a sales invoice. It is generally issued once the seller receives a purchase order and repays their obligations accordingly. A purchase invoice contains almost the same information a regular invoice does: payment terms, description of the order, shipping details, etc.

- VAT Invoices. If you are a VAT-registered taxpayer, you will have to issue an extra document, known as a VAT invoice. In this type of financial document, you will still need to provide basic invoice information. However, it also requires the inclusion of your VAT registration number.

- You may find it useful to know what a proforma invoice is; we have covered this financial document in this article.

How Are Invoices Used?

An invoice generally includes the description of the products that must be delivered to the client, the price of the items, and the payment details. Today most companies use online invoicing services (like Finom) to issue invoices and accept payments from their customers.

Consider implementing an intelligent online invoicing system to your business - it will make your life considerably easier. For instance, it can enable you to schedule reminders for your clients when they need to pay for the goods received or notify the accountants when the payment has arrived. No more awkward emails - you won’t have to request the money yourself.

Providing that you keep your invoice database neat, you can simplify the process of paying all applicable business taxes. This is so because the invoices provide precise information on the revenue earned during the tax year. What else are invoices used for?

- Collecting money. Vendors won’t receive the payment for selling products or services until they send an invoice to the purchaser.

- Providing visibility. An invoice provides a detailed description of the ordered product, giving the accounting department the requisite transparency into what other departments buy. Therefore, invoices enable the projections of funds.

- Managing payments. Invoices can be used as analytical instruments to keep track of how many products have been sold, how much money has been earned, and how many bills are not yet paid.

- Creating a paper trail. Invoices create a "paper trail" between the purchaser and the merchant. By issuing, sending, and accepting invoices, the parties establish a transparent legal framework and agree to fulfill the terms of the respective payment agreement.

What Are the Benefits of Invoices?

Used wisely, invoices are a great solution for small businesses to supervise revenue flow and expenses. Besides providing a written record of completed services and delivered products, invoices also make it easier to charge customers on time. You will still have some accounts with outstanding balances, but employing an online invoicing system will definitely reduce the number of debtors.

- No stress during the tax season. Everybody hates paying taxes. So why not do something to make the tax season go more smoothly? Providing that your invoicing system is in order, you can access the information at any time and facilitate the process of auditing and reconciling.

- Accelerated processing and payment. Resist the temptation and avoid including the bare minimum in an invoice. We know it seems like a good idea to save you some time; however, if you provide more information on the order, customers will be less likely to torture you with millions of questions in the future. Comprehensive invoices can serve as great tools for speeding up the payment process.

- Recording your accounts receivable. Invoices can also serve the purpose of recording your accounts receivable. Accounts receivable (AR) is the payment due for products or services that have already been delivered to the customer but are not yet paid. Maintaining such statistics is much easier if you implement a healthy invoicing system. The collected data might be used not only by the accounting department but also presented to prospective investors, for them to embrace how well your company is doing.

- Empowering your brand identity. Make use of invoicing software (like the Finom app) to personalize your invoices. Personalization can greatly influence the client’s perception of your business and enhance the image of the company overall.

Embracing the Differences Between a Purchase Order and an Invoice

The main difference between an invoice and a purchase order is their goal. A purchase order is issued when a buyer requests the delivery of goods or services. At the same time, an invoice serves as a payment request and is created after the order is fulfilled.

What about the similarities? As we have already mentioned above, POs and invoices are not identical but are related, as they reference one and the same product. They contain identical information regarding the purchaser and the vendor, e.g., names or addresses, but what’s more significant, both documents constitute a legally binding agreement. An invoice for a purchase order is issued upon completion of the ordered service.

Below we list all of the similarities and differences between these two financial documents in one table:

| Invoice | Purchase order | |

|---|---|---|

| Primary function | Payment request | Order confirmation |

| Initiator | Seller | Buyer |

| Recipient | Buyer | Seller |

| Date of issuance | Once the payment terms are fulfilled | Once the order is placed |

| Contents |

|

|

You should also read our article entitled "Invoice vs. Receipt." It covers the differences between these two financial documents.

A Final Word

The financial system’s work can be hard to conceive, especially when you try to move away from the realm of theory and advance into action. All the paperwork you need to file as a small business owner can be quite a burden. However, taking care of the financial health of your business is an essential undertaking that can’t be ignored. Lucky for you, there are multiple ways to automate and optimize some of the processes inside your company.

There is a solution that can change your business life for good. You can benefit from a wide range of financial services offered by Finom, including a top-notch online invoicing system. Install the Finom app (Finom for IOS, Finom for Android) and explore the advantages of its innovative e-invoicing service. Accounting, invoicing, multi-banking, reconciliation — all of these finance management features are available right on your phone. Manage your invoices and other financial documents in a few clicks.

If you're a small business owner, you've probably thought about using accounting software. Learn more about the best accounting software solutions in our article.

Last articles

Finom plans are changing – what it means for you

The Best CRMs for Small Businesses: How to Find Your Perfect Software

Finom Raises €50M in Series B Funding Led by General Catalyst and Northzone

Passkeys: Powering Finom’s Security Upgrade

Pro Forma Invoice: What It Is and Its Meaning

Direct Debit: What It Is and What Are the Advantages?

Invoice Number: What Is It and Why Should I Generate One?