Business account

A €0 Solo plan for freelancers with a local IBAN

Simplify your freelancing with a local IBAN, convenient invoicing, and accounting tools – all completely free

Top-notch features to help you compete with big players

A €0 Solo plan for freelancers with a local IBAN

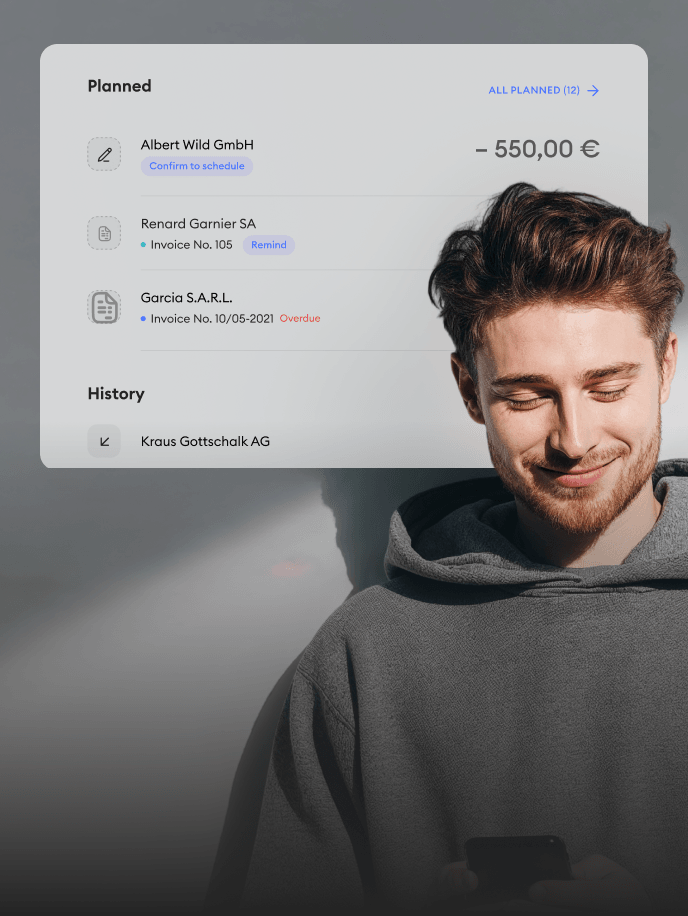

Clear, convenient, professional invoices ready in seconds

Managing your taxes can be easy. Let us show you how

Issue multiple free VISA debit cards with 0% commission for you and your team

Optimize finances – transactions being automapped with invoices and receipts in accounting ready data

Be it receipt, invoice or any other important document – collect it in Finom secure storage in several clicks

Extract data from receipt or any other document with auto-recognition feature

Track and categorize expenses online. Control where you spend more and reduce costs month-by-month

via smartphone or desktop

Subscription plans at a fair cost tailored to fit your business.

For freelancers who need simple, essential features

For individual entrepreneurs or small teams taking their first steps. Simple, essential tools to start and stay in control

For small to medium-sized businesses with straightforward needs. Flexible tools and higher limits for daily operations

Business account

Business account

Business account

Users included

1

Users included

2

Users included

Cashback

0%

Cashback

1%

Cashback

3%

AI Assistant

AI Assistant

AI Assistant

Chat support

Up to 1 business day

Chat support

Up to 3 hours

Chat support

Up to 3 minutes

Account Manager

Account Manager

Account Manager

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Payment Solutions

Provided by Finom Payments

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Personal IBAN (unique account number for global transfers)

Free outgoing SEPA transfers

€2 500

Free outgoing SEPA transfers

€25 000

Free outgoing SEPA transfers

€50 000

Free VISA physical cards per user

0

Free VISA physical cards per user

1

Free VISA physical cards per user

3

Free VISA virtual cards per user

1

Free VISA virtual cards per user

3

Free VISA virtual cards per user

10

Outgoing international payments

1%

Outgoing international payments

0.50%

Outgoing international payments

0.40%

Role and user management

Role and user management

Role and user management

Scheduled payments

Scheduled payments

Scheduled payments

Bulk payments

Bulk payments

Bulk payments

Compare plans

Solo

BasicYou save € 48

SmartYou save € 72

Business Account

Personal IBAN (unique account number for global transfers)

Multiaccounts

Cashback

0%

1%

3%

Users included

1

2

Expense management

Team cards personalization

AI Assistant

Chat support

Up to 1 business day

Up to 3 hours

Up to 3 minutes

Email support

Up to 1 business day

Up to 3 hours

Up to 30 minutes

Weekend support

Account Manager

Provided by Finom Payments

SEPA payments

Transfers between Finom's users in a few seconds

Extra SEPA OUT & Direct Debit transfers (per month)

€0 - €2 500

0%

0%

0%

€2 500 - €10 000

0.30%

0%

0%

€10 000 - €25 000

0.30%

0%

0%

€25 000 - €50 000

0.30%

0.03%

0%

€50 000 - €100 000

0.30%

0.03%

0.025%

€100 000 +

0.30%

0.03%

0.025%

SEPA Instant transfers

Decline of Direct Debit

5 €

5 €

5 €

Scheduled payments

Bulk payments

Card payments

Free Physical card

0

1 per user

3 per user

Physical card monthly maintenance

3 €

Monthly card payment limit

€100 000

€100 000

€100 000

Monthly ATM withdrawal limit

500 €

2000 €

5000 €

Card payments in foreign currency (non-EUR)

€0 - €500

3%

0%

0%

€500 - €1 000

3 %

2 %

1 %

€1 000 +

3%

2%

1%

ATM withdrawals in foreign currency (non-EUR)

3 %

2 %

1 %

Card payments for certain MCCs (%, minimum 1 €)

€0 - €500

3 %

2 %

1 %

€500 - €2 500

4 %

3 %

2 %

€2 500 - €5 000

5 %

4 %

3 %

€5 000 +

6 %

5 %

4 %

ATM withdrawal amounts (applicable for all cards)

€0 - €500

1%

0%

0%

€500 - €2 000

3%

1%

0%

€2 000 - €5 000

5%

5%

3%

€5 000 - €10 000

8%

8%

5%

€10 000 +

8%

8%

8%

Monthly fee for the inactive physical card

€0

€1

€0

Virtual card

1 per user

3 per user

10 per user

Monthly fee for virtual VISA Card

€0

€0

€0

Monthly fee for the inactive virtual card

1 €

0 €

0 €

Free card express delivery

Basic card limits management

Advanced card limits management

Special offers

Prime Card

Prime Card monthly maintenance

9,99 €

9,99 €

Cashback

1%

1%

Free card payments in foreign currency (non-EUR)

€20 000

€20 000

Free access to business lounge

2

2

Free eSIMs

1

1

Monthly fee for nonactive card

€0

€0

Express delivery for physical cards

€0

€0

International payments

Incoming international payments (fee per payment)

5 €

5 €

5 €

Outgoing international payments (fee per payment)

5 €

5 €

5 €

Fee for the outgoing volume of international payments

1%

0.50%

0.40%

Coverage of the International transfer cost, optional

35 €

35 €

35 €

Accounting & Invoicing

Accounting integrations up to 30 tools (Sage, NetSuite, Odoo, etc.)

Reconciliation of invoices and receipts

Recognition of invoices and receipts

Role and user management

Customization of invoice templates

Visual analytics of income and expenses

Additional fees for special services

Express delivery of Finom Card

€15

€15

Reference letter fee for business

€80

€80

€80

Business Account Closure Refund Processing Fee

€5

€5

€5

Recall of outgoing SEPA SCT

€15

€15

€15

Inquiry on SEPA SCT (Payment Investigation)

€15

€15

€15

Recall of international payments

€60

€60

€60

Outgoing payment investigation

Incoming payment investigation

Fee for providing MT103

€20

€20

€20

Fee for MT199 request

€45

€45

€45

Audit confirmation statement

€100

€100

€100

Refusal to redeem an authorized direct debit due to insufficient account balance

€1

€1

€1

Unarranged negative balance on Finom Business Account

€1 per day

€1 per day

€1 per day

Dunning letter (per letter)

€5

€5

€5

Card dispute for an authorised transaction (per transaction)

€15

€15

€15

Administrating irregularities applied to the Finom Business Account

€25

€25

€25

Personal account manager

Onboarding fee

Applied individually

Applied individually

Applied individually

Compliance fee

Please note that certain services are directly provided to you by a payment institution. Finom charges you for the platform services.

For our detailed price list, download PDF here

Read real, authentic reviews

Help is just a click away

Interactive Help Center available 24 hours

24/7

Fast response time

Contact us on e-mail: hello@finom.co

Your money is in safe hands because we strive to provide a high level of security to protect it:

In addition to the security measures on the Finom platform and applications provided by PNL Fintech B.V., there are also legal regulatory measures of the institution providing your business account, i.e. Safeguarding your account via Finom Payments B.V.:

For more information, please refer to the Terms of Finom Payments.

Whether you are a freelancer or own a company, opening your Finom business account only takes a few minutes.

You will only need three things for it:

From automation to cost optimization, discover how to use AI today. Download our free expert guide with real case studies and actionable insights.

Plan configurator

1 / 4